Transport car to Poland and the process is more straightforward than most people think. Whether you’re relocating permanently, sending a vehicle to family, or importing a classic car, understanding the steps involved helps you steer international vehicle logistics with confidence.

Quick Answer: How to Transport a Car to Poland

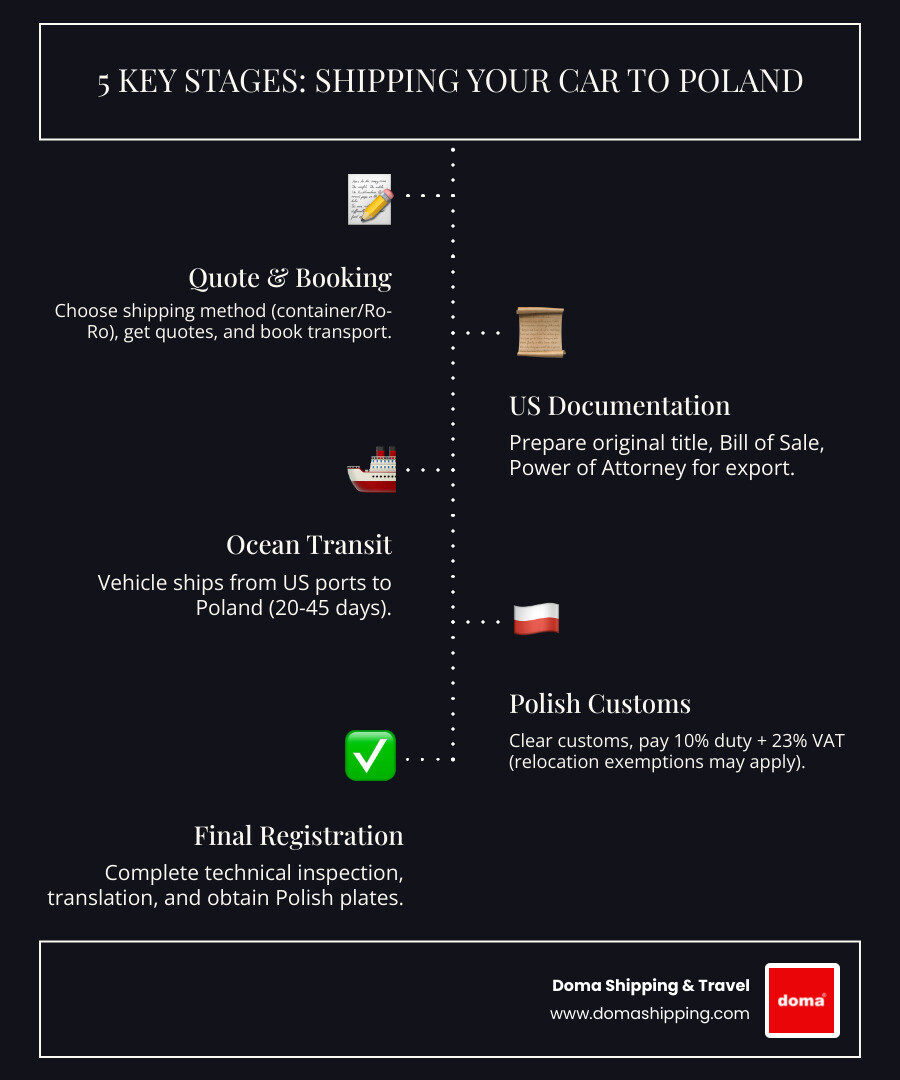

Shipping a car overseas involves coordination between US export regulations, international freight logistics, and Polish import requirements. The ocean transit itself typically takes 20-35 days from the East Coast or 30-45 days from the West Coast to Poland’s Baltic Sea ports.

Most people shipping vehicles to Poland choose container shipping because it offers better protection and allows you to pack personal belongings with the car. Others prefer Ro-Ro (Roll-on/Roll-off) service for its simplicity with drivable vehicles, though it doesn’t permit additional items inside.

Key considerations include the shipping service, US export documentation, ocean freight, and Polish import requirements. Upon arrival, a 10% import duty and a 23% VAT are typically applied, with a reduced 7% VAT for authentic classic cars over 30 years old. If you’re relocating to Poland permanently and have owned your car for more than six months, you may qualify for the “mienie przesiedleńcze” (relocation property) exemption, which can provide an exemption from import duties.

This guide walks you through every stage of the process—from selecting the right shipping method and preparing documentation to clearing Polish customs and registering your vehicle for Polish roads.

Transport car to Poland terms to learn:

When you decide to transport car to Poland, one of the first and most crucial decisions you’ll make is selecting the right shipping method. The two primary methods are container shipping and Roll-on/Roll-off (Ro-Ro) shipping. Each has its own advantages and considerations regarding vehicle security, the ability to ship personal items, and overall logistics. At Doma Shipping, with our roots in Illinois, we primarily focus on efficient container solutions to ensure the best service for our clients.

Container shipping is often the preferred method for shipping vehicles from the USA to Poland, especially for clients originating from our Illinois locations. This method offers unparalleled security and flexibility. Your vehicle is securely loaded inside a steel shipping container, protecting it from the elements and potential damage during transit.

We offer various container shipping options to suit your needs:

Container shipping is particularly beneficial if your vehicle is inoperable, as it doesn’t need to be driven onto the vessel. It’s also the only method that allows you to ship personal belongings inside your car (we’ll dive into this more later).

Ro-Ro shipping involves driving your vehicle onto a specialized vessel, much like driving onto a ferry, and securing it below deck. These vessels are designed to transport a wide range of wheeled cargo. While it might sound convenient, Ro-Ro shipping for regular cars from the USA to Poland is generally less common and can be more challenging to arrange compared to container shipping. Direct service from the USA to Polish ports is not always available for Ro-Ro, often requiring transshipment through other European ports like Bremerhaven, Germany, which can lead to additional handling and longer transit times.

A key requirement for Ro-Ro is that your vehicle must be in fully drivable (operational) condition. Moreover, port regulations for Ro-Ro vessels are strict: you cannot ship any personal belongings inside the car. The vehicle must be empty, except for factory-fitted items. This method is primarily used for oversized vehicles or heavy machinery, rather than standard passenger cars heading to Poland from the USA.

| Feature | Container Shipping | Ro-Ro Shipping |

|---|---|---|

| Security Level | High (enclosed, protected from elements) | Moderate (exposed to elements on open decks) |

| Ability to Ship Personal Items | Yes (with proper declaration and packing) | No (vehicle must be empty) |

| Vehicle Condition Requirement | Operable or inoperable | Must be fully operable (drivable) |

| Best Use Case | High-value, classic, inoperable cars; shipping personal goods; efficient consolidated options | Oversized vehicles, heavy machinery; direct routes (less common for passenger cars to Poland) |

Bringing your car into Poland from the USA involves adherence to specific Polish and European Union (EU) import regulations. Understanding these rules is key to a smooth process after your vehicle arrives.

When your vehicle arrives in Poland, it will be subject to import duties and Value Added Tax (VAT). These are significant components of the import process and are calculated based on the car’s declared amount:

These taxes are applied to the vehicle’s customs declaration, which includes the declared amount and other factors. It’s an important part of the process to consider when planning to transport car to Poland.

Good news for those moving! If you’re relocating to Poland permanently, you might be eligible for the “mienie przesiedleńcze” (relocation property) exemption. This special provision allows for an exemption from import duties on your vehicle, providing significant benefits.

To qualify for this exemption, you typically need to:

If your vehicle qualifies as relocation property, the customs clearance is handled under a specific provision for a nominal administrative charge, rather than being based on a percentage of the vehicle’s declared amount. This is a considerable benefit for individuals making a permanent move. Our team can help you understand the requirements and steer the application process for Mienie przesiedleńcze z USA do Polski.

Shipping specialized vehicles like classic cars, luxury vehicles, or electric cars to Poland comes with its own set of considerations:

After your vehicle clears customs, the final step to get it on Polish roads is registration. This process ensures your car meets local standards and is legally recognized.

For comprehensive details and official guidance on registering a vehicle in Poland, you can consult the Official guidance for citizens.

Bringing your car into Poland from the USA involves adherence to specific Polish and European Union (EU) import regulations. Understanding these rules is key to a smooth process after your vehicle arrives.

When your vehicle arrives in Poland, it will be subject to import duties and Value Added Tax (VAT). These are significant components of the import process and are calculated based on the car’s declared amount:

These taxes are applied to the vehicle’s customs declaration, which includes the declared amount and other factors. It’s an important part of the process to consider when planning to transport car to Poland.

Good news for those moving! If you’re relocating to Poland permanently, you might be eligible for the “mienie przesiedleńcze” (relocation property) exemption. This special provision allows for duty-free importation of your vehicle, providing a significant exemption.

To qualify for this exemption, you typically need to:

If your vehicle qualifies as relocation property, the customs clearance is handled under a specific provision for a nominal administrative charge, rather than being based on a percentage of the vehicle’s declared amount. This is a considerable benefit for individuals making a permanent move. Our team can help you understand the requirements and steer the application process for Mienie przesiedleńcze z USA do Polski.

Shipping specialized vehicles like classic cars, luxury vehicles, or electric cars to Poland comes with its own set of considerations:

After your vehicle clears customs, the final step to get it on Polish roads is registration. This process ensures your car meets local standards and is legally recognized.

For comprehensive details and official guidance on registering a vehicle in Poland, you can consult the Official guidance for citizens.

We understand you likely have many questions about how to transport car to Poland. Here are some of the most common inquiries we receive:

This is a very common question, and the answer depends on your chosen shipping method:

Protecting your investment during its journey across the ocean is paramount. While basic carrier liability is usually included with shipping services, it is often limited by international maritime law (e.g., the Carriage of Goods at Sea Act). For comprehensive peace of mind, we strongly recommend opting for additional marine cargo insurance.

Typically, you can choose from:

We can help you explore the available insurance options to ensure your vehicle is adequately protected from the moment it leaves our Illinois facility until it arrives in Poland.

The time it takes to transport car to Poland varies depending on the US departure port and the specific shipping method. Generally, ocean transit times are as follows:

These are port-to-port estimates and do not include the time for inland transport within the USA to the departure port (from our Illinois locations), or the time required for customs clearance and final delivery in Poland. Factors such as weather conditions, port congestion, and customs processing can also influence the overall timeline. We always strive to provide the most accurate and up-to-date transit estimates for your specific shipment.

Once your vehicle has successfully steerd the ocean and cleared Polish customs, the final leg of its journey involves collection and, if applicable, further inland transport. At Doma Shipping & Travel, we believe in providing a seamless experience from start to finish, ensuring that your car arrives safely and efficiently.

When your vehicle reaches its destination port in Poland, our local partners will coordinate its release. This involves:

Our over 30 years of experience in international logistics means we’ve perfected the process of shipping cars from the USA to Poland. We handle the complexities so you don’t have to, providing comprehensive services beyond just shipping. From our Illinois locations, we manage everything from the initial pickup to the final delivery, ensuring that your experience of moving your ride to Poland is as smooth as possible.

For more detailed information on shipping vehicles, including specific guidance for Samochody z USA do Polski, don’t hesitate to reach out. We’re always ready to help you transport car to Poland with confidence.